business liability insurance ontario

Court fees and allowance for daily hearings. Take your business to the next level with contractor liability insurance.

Business Insurance For The Handcrafted Industry Soap Queen

Hiring a defence lawyer for legal representation.

. Zensurance provides a concierge service to startups and small businesses to manage all their business insurance needs. Make sure your business is properly insured for common liabilities and threats. Dont lose your business because of events that youre not covered by the right Commercial General Liability Insurance sometimes referred to as CGL Insurance.

The settlement with the prosecution. The exact cost for your insurance policy varies according to factors such as. The coverage protects against financial loss including but not limited to physical damage legal liability bodily injury accident benefits and medical payments as a result of an accident arising out of the ownership use maintenance or care-custody control of a.

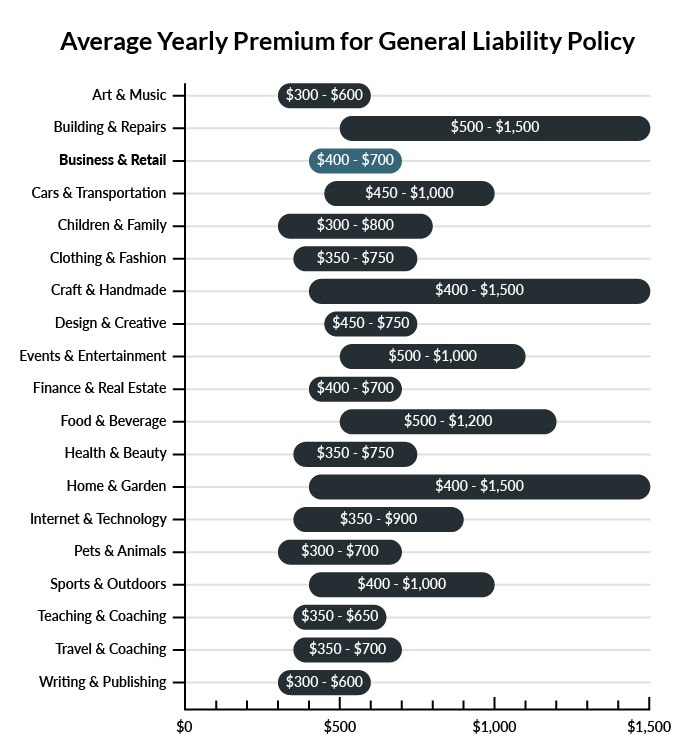

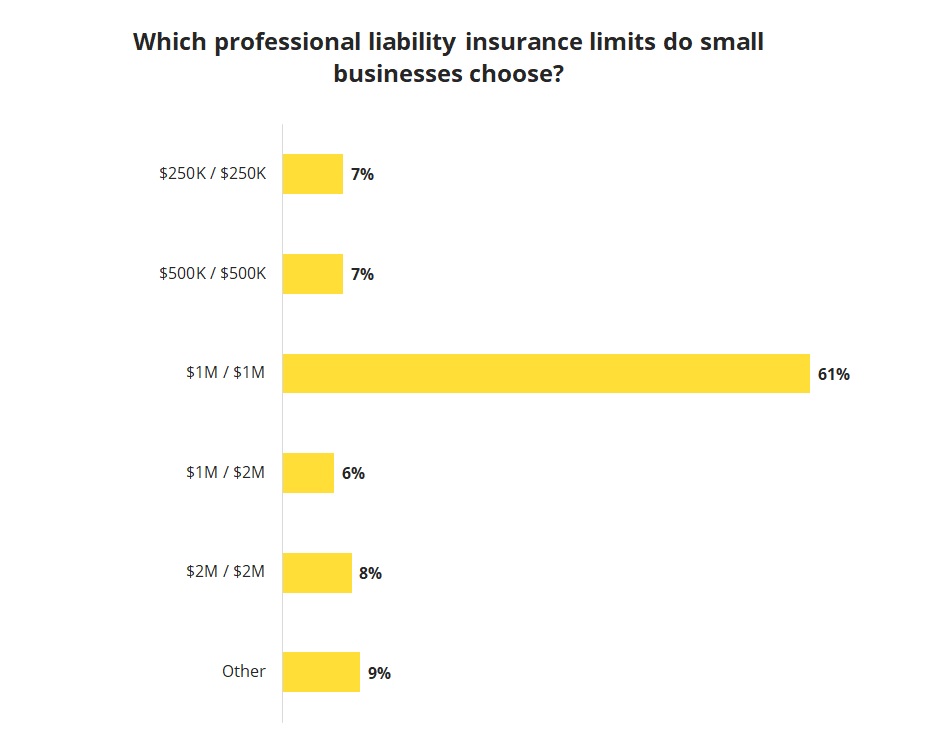

Many small business owners will pay between 500 and 2000 every year for their insurance. The most common types of business insurance are commercial property insurance. How Much Does Commercial General Liability Insurance Cost.

Get the best protection cover for your business with Reith Associates. Directors and officers liability insurance also known as management liability insurance covers damages involving wrongful acts committed in the discharge of your duties including. At ThinkInsure our advisors will find the best plans and search for the most affordable rates.

It can include things like commercial property insurance commercial general liability insurance errors and omissions insurance and so on. It generally covers the cost of. Since every business has unique needs every policy will be slightly different.

Bodily Injury Physical harm to an individual. General Third-Party Liability included in our commercial policies cover four types of claims. In short Ontario Employer Liability Insurance protects employers whether they have WSIB coverage or not from lawsuits stemming from workplace-related injuries illnesses and deaths.

Thousands of contractors depend on our services to get. Legal Expenses Includes defense costs judgement awards and settlements. Keep reading to learn more about small business liability insurance and how it will protect you.

Negligence misconduct errors and omissions breach of duty misleading statements or any other act that could be held against you in your capacity as a director or officer. Business liability insurance mitigates those risks and provides peace of mind that your business is covered so youre able to focus on whats essential to achieve the goals youve set for your business. This is only an average price so you could pay more or less depending on your industry and personal operations.

With Ontario commercial general liability insurance your legal expenses will be covered if your business is sued for causing bodily injury or property damage to a third party due to negligence. Even if youre mandated to have workers compensation coverage through the Workplace Safety Insurance Board youre not immune from personal injury litigation. General business liability insurance protects you in cases where your business has been deemed legally responsible for injuries caused to another person or damage to their property.

Business insurance is just an umbrella term that refers to the whole bundle of liability insurance policies that apply to a business. As your local insurance experts we know that each business in Ontario is. However there are certain coverages most small business will need and liability is one of those coverages.

The cost can vary depending on a variety of factors including. Compare small business insurance quotes in Ontario from the leading insurers in Canada. Ontario liability insurance helps keep businesses operating during the legal process and gives employees peace of mind that their work is protected.

Business Liability coverage is calculated with your business insurance quote Whether your business operations are based from home or out of a commercial space your business requires insurance protection that will respond to customers or other third party lawsuits claiming that your products or your services have caused them to suffer bodily injury or property damage. If you own a manufacturing or service business or retail shop run an office provide personal or contract services or run a farm or ranch well make sure that you have the right Business Liability. With general liability coverage your business is protected if youre found legally liable for injuries or property damage caused by your product accidents on your premises your operation or at your customers location.

While you certainly dont intend for anyone to become injured on your property accidents do happen. In the event of a lawsuit it protects. The majority of commercial general liability insurance policies cost between 450 and 500 per annum for small or medium businesses in Canada requiring 2 million worth of coverage.

Business auto insurance covers vehicles used primarily for business owned by a person or corporation. Business liability insurance does more than you can think of at the start. For a small business in Ontario you can anticipate spending approximately 450 per year on a basic commercial general liability insurance policy with a 2M limit.

Well help you save without sacrificing coverage. Business insurance or commercial insurance protects business owners of all sizes from potential losses as a result of unforeseen events that can occur during the day-to-day operation of your business this includes property damage injuries theft or even tech errors. Although some policies cost over 1000 a year.

The price range for small business insurance in Ontario is dependent on a number of factors. We leverage over 100 of the best insurance companies in Ontario in order to provide thousands of contractors tradespeople and professionals with the coverage they need in order to protect their business and assets. Protection from legal action is one of the greatest benefits of Ontario liability insurance.

Canada S Best Professional Liability Insurance Insurance Business Canada

Ecommerce Business Insurance Options For Retailers 2022

Are Subcontractors Covered Under My Contractors Insurance Contractors Insurance Ca

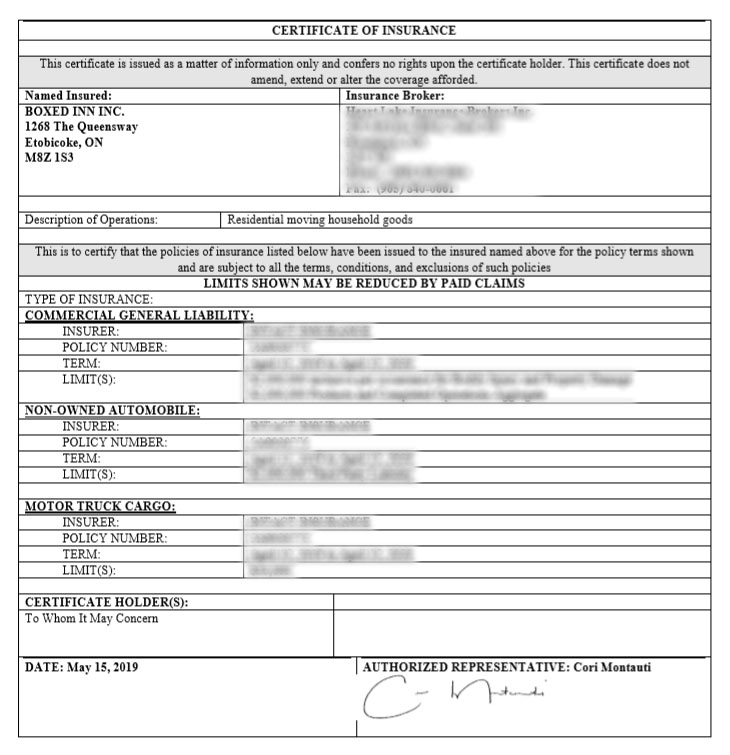

What Is The Required Insurance For Moving Companies In Ontario Boxed Inn

Professional Liability Insurance For Canadian Businesses Kbd

Small Business Insurance Ontario Zensurance

General Liability Vs Professional Liability Professionalscoverage Ca

Business Insurance For Pest Control Companies

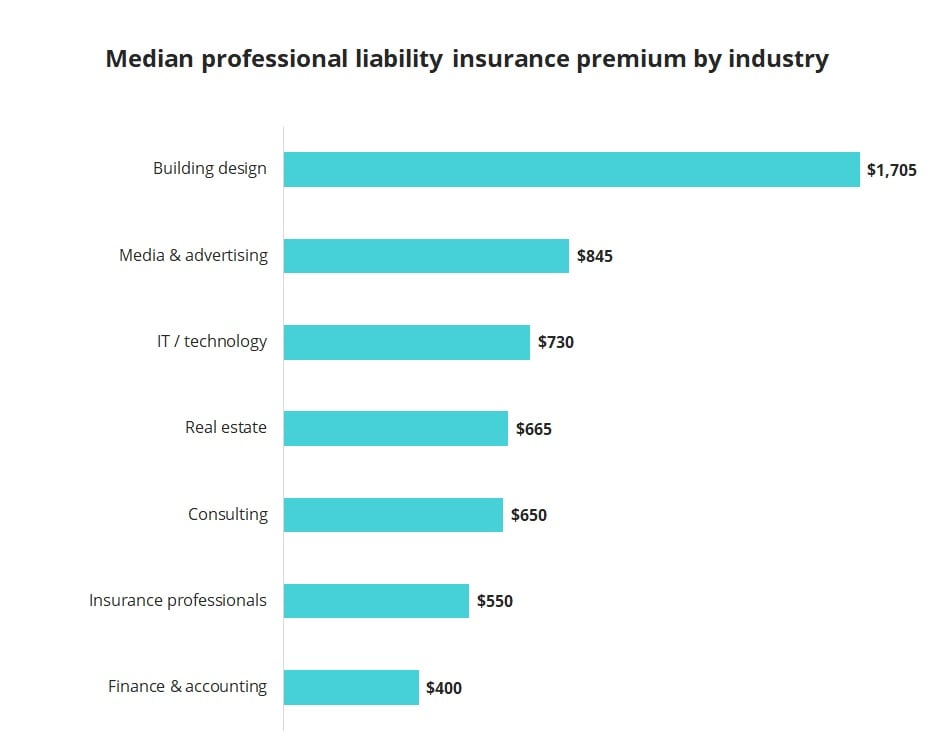

Professional Liability Insurance Cost Insureon

Business Insurance Ontario 2020 Plain English Insurance Guide For Ontario Business Owners

General Liability Insurance Quotes Quotesgram

Professional Liability Insurance Cost Insureon

Proof Of Car Insurance In Ontario New Digital Pink Slips

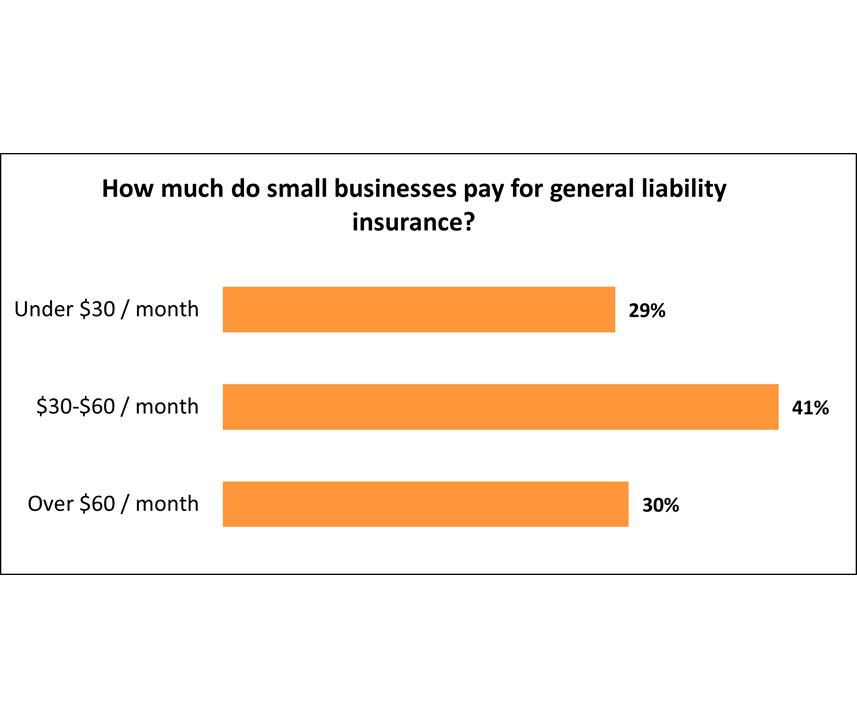

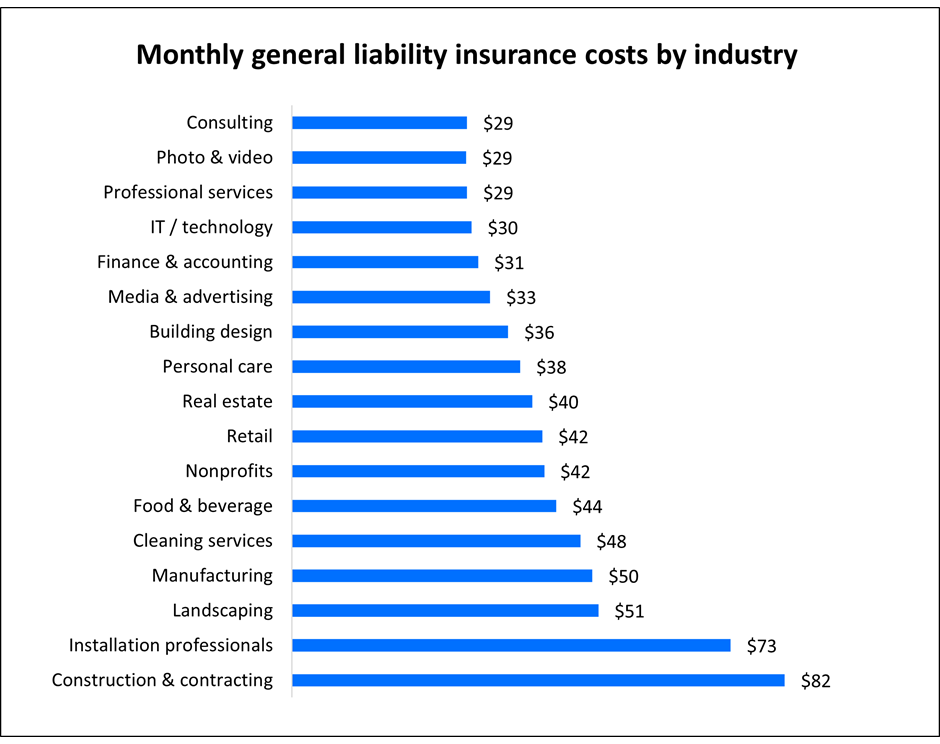

General Liability Insurance Cost Get Your Quotes Today Insureon

How Much Does Snow Plowing Insurance Cost Commercial Insurance

General Liability Insurance Cost Get Your Quotes Today Insureon

Professional Liability Or Errors And Omissions